The Dynamic Interplay of Crude Oil Futures and Equity Markets Across Pre- and Post-Financialisation Eras

Abstract

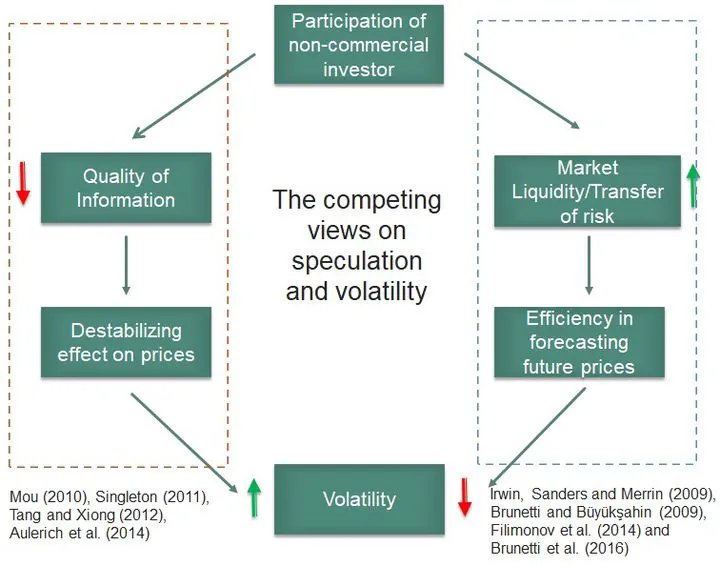

We examine the impact of financialisation in futures markets on the relationship between crude oil futures and equities. Our analysis incorporates systematic patterns of commodity price volatility, including seasonality and maturity effects, across two distinct periods: the pre-financialisation era (1993–2003) and the post-financialisation era (2004–2019). We find that non-commercial speculation negatively influences crude oil futures’ volatility before financialisation (1993–2003), whereas liquidity emerges as a significant negative determinant of volatility in the post-financialisation period (2004–2019). Seasonality effects have weakened since financialisation, and the Samuelson effect, which describes the tendency of contract volatility to increase as expiration approaches, is also diminished in the post-financialisation period.